Not known Facts About Surety Bonds vsLetters of Credit: The Ultimate Guide

Some Known Details About Bond Services Surety Bonds, Insurance, Contractor, Court

When you buy several business policies from The Hanover through your regional independent representative, you will delight in the benefit of one contact for all your insurance requires consisting of customer care, insurance coverage billing, renewals and claims.

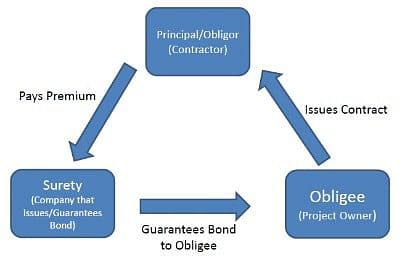

/ A surety bond is a type of risk management tool; it's a contract where the surety (typically a large insurance provider) offers their financial backing of the principal (the party responsible for satisfying a commitment) for the benefit of the obligee (the celebration to whom the primary owes the obligation).

Surety Bonds vsInsurance Policies: What's the Difference? - RLI Corp

What is a Surety Bond? I Found This Interesting Explained.

The Basic Principles Of What Is a Surety Bond? How They Work, Where to Get One

Unlike a standard loan or insurance coverage agreement, which typically included two unique celebrations, a surety bond is a contract in between three celebrations: This is the party accountable for satisfying a commitment, that obligation being to finish a defined task or simply to perform service in a manner acceptable to relevant laws and regulations.

Most of the times, the principal does not seek a surety bond until that bond is required of them by another celebration. This is the party owed the responsibility from the principal. This party might be the public who benefits from the primary carrying out business in accordance with suitable laws and guidelines.

Infographic: The Complete Surety Bond Application Process

The 4-Minute Rule for The Importance of Surety Bonds in Construction

If an obligee feels the principal hasn't satisfied the terms of the bond, the obligee might sue against said bond seeking monetary compensation for damages. As long as that claim is legitimate, the surety business backing the bond warranties payment. This is the celebration that supplies the economically backed warranty to the obligee that the principal can satisfying the responsibility.

When the surety figures out the principal is both capable of satisfying the responsibility and capable of remedying circumstances where a breach in the obligation has occurred, the surety will use itself as the intermediately accountable celebration, economically, in the kind of a surety bond. Upon payment of the surety bond premium and issuance of the bond, the surety ends up being the initial path of option for the obligee in instances where the principal has actually stopped working to meet the matching commitment.

The Main Principles Of What is a surety bond, and how do I secure one?

Later, the principal should pay the surety back the complete amount of the claims settlement, possibly with extra interest and fees included. Surety Bond Meaning To understand what a surety bond is, it can be practical to compare it to insurance. A surety bond resembles an insurance coverage in some methods but has key distinctions.